Argentina’s selective recitation of context-specific quotations from arguably biased commentators and institutions notwithstanding, the preferred construction of pari passu clauses in the sovereign debt context is far from “general, uniform and unvarying”…

That’s the U.S. Court of Appeals for the Second Circuit on Friday – in a sovereign debt ruling which might just set an interesting precedent or two.

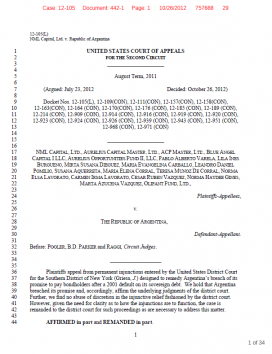

Click for the full opinion:

The Court has ruled that the Argentine government did err after all in paying out on its restructured sovereign debt above holdouts’ bonds — and inter alia casting the interpretation of pari passu clauses, promises of “equal payment” that are fairly common across sovereign debt, into some turbulentis inordinatio. (The Court thus affirms an earlier District Court ruling by Judge Griesa, who ordered Argentina to pay bondholders equitably.) We suspect this ruling could also be controversial in what it says about the immunity of sovereign assets from holdouts…

The ruling firstly leaves Elliot Associates on something of a roll in its 10-year fight against Argentina, after the fund acquired a small slice of the Argentine navy earlier this month in a bid to secure assets for payment.

But this is also really not how a few observers expected the case to go, including Anna Gelpern and Felix (“ultimately the chances are that Argentina will prevail”). After all, as both pointed out, the law surrounding the “meaning” of pari passu is not easy to fathom, particularly over the issue of paying bondholders pro rata. Nor is picking over whether there are shades of “immunity” in the US Foreign Sovereign Immunities Act. Or at least you might have thought. Anna has also just now written a really good analysis of what this case might now mean, so we have only a few points to add.

Firstly it’s interesting that the court has appealed to pragmatism in rejecting Argentina’s argument that the terms of its restructured bonds never legallysubordinated the legacy debt. The court is essentially saying to Argentina: “You haveeffectively subordinated it by ‘repeatedly asserting’ that you will never pay out on it, and passing a law at home that forbids paying it so long as the restructured bonds are to be paid out. And in the first place, pari passu does not have that narrow meaning of legal subordination you think it does.”

As Anna writes, the court nevertheless didn’t go into massive detail about this law that Argentina passed (the Lock Law) despite its pretty clear effect. Instead the rejection of Argentina’s case is very broad – this “effectiveness” test. We wonder if, despite citing all the uncertainty over the meaning of pari passu, the court has nevertheless ended up nailing it down quite a bit — nailing it down in way that widens the scope for suing sovereigns for violating this clause de facto.

Over to immunity. The Court also gives short shrift to the idea that Griesa’s orders for relief will restrict Argentina’s immune assets in the United States in a way that contradicts the FSIA. Here’s the key par:

They do not attach, arrest, or execute upon any property. They direct Argentina to comply with its contractual obligations not to alter the rank of its payment obligations. They affect Argentina’s property only incidentally to the extent that the order prohibits Argentina from transferring money to some bondholders and not others. The Injunctions can be complied with without the court’s ever exercising dominion over sovereign property. For example, Argentina can pay all amounts owed to its exchange bondholders provided it does the same for its defaulted bondholders. Or it can decide to make partial payments to its exchange bondholders as long as it pays a proportionate amount to holders of the defaulted bonds. Neither of these options would violate the Injunctions. The Injunctions do not require Argentina to pay any bondholder any amount of money; nor do they limit the other uses to which Argentina may put its fiscal reserves. In other words, the Injunctions do not transfer any dominion or control over sovereign property to the court.

Long and involved, isn’t it?

Now, in terms of possible ripple effects, this is all New York contract law. So the leeway that the court seems to give to creditors in this case doesn’t have a direct bearing on any future eurozone debt restructuring, for example. The background to NML v Argentina also dates back to a funny time in sovereign restructuring. The court seems to suggest that by lacking collective action clauses in its debt, Argentina was uniquely vulnerable to holdouts in a way no government would be ever again. CACs are now regularly implanted in bonds, and are the sovereign restructuring tool of choice. Well,maybe — ask the holdouts in the Greek PSI. And also look at how the standard-setters for this kind of thing are really most concerned about getting the right aggregation clauses in CACs. (These clauses allow holders across a sovereign’s bonds to vote on a restructuring offer, versus taking votes by individual series of bonds.)

But the court itself shows some nervousness in its ruling about sovereign bond holdouts becoming able to sue third parties that assist a sovereign debtor, such as “banks acting as pure intermediaries in the process of sending money from Argentina” to holders of the restructured debt. And so the Court has asked for the original injunction on Argentina to be clarified…

Something which we imagine Bank of New York – trustee to the restructured holders – will be very interested in.

Related link:

Whose crisis was this anyway? – Letter to the FT

Whose crisis was this anyway? – Letter to the FT

Keine Kommentare:

Kommentar veröffentlichen